SME Loan Company- Heartbeat

Executive Summary

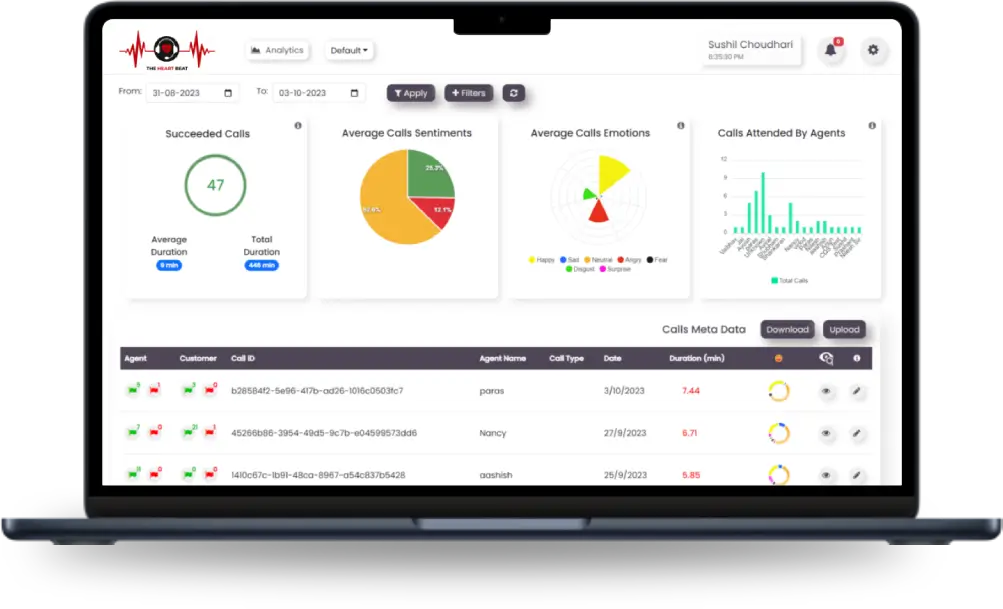

IOanyT Innovations product, The Heartbeat extended as SaaS has helped this loan company overcome the problem of manual call audit to identify the KYC gaps and efficiency in agent conversations.

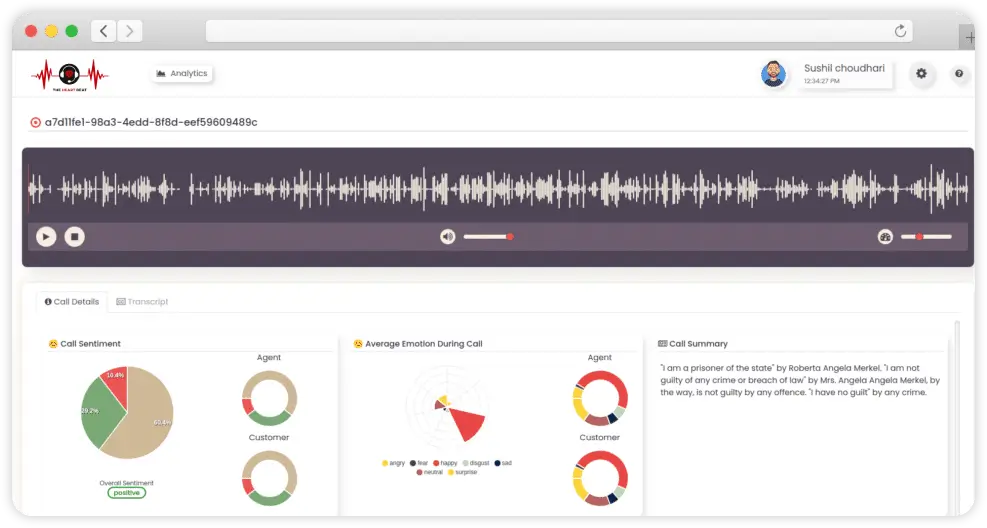

The stakeholders can view detailed analytics of each call and identify the KYC information gaps and EMI reminder calls to monitor agent performance more swiftly in a far more transparent & effective manner for better tracking to attain higher productivity by streamlining the day-to-day business workflow.

Customer

This fintech company is having online lending platform started with an endeavour to solve the problem that SMEs face in accessing Quick, Flexible and Adequate funds for growing their Businesses. Over 80% of Loan proposals from SMEs currently are rejected by institutional channels on account of inadequate financial history or collaterals. With the fast and ubiquitous digital adoption avenues to leverage data analytics, we are standing on the verge of Banking transformation in this country which will help us efficiently cater to the large untapped and unserved demand. We believe our technology-powered online marketplace is the best model to meet the financial requirements of SME’s who do not have credit history and hence cannot avail loans from traditional banking channels.

They do lot of calling to verify the KYC details of loan seekers and post servicing call for loan EMI repayments, with adoption of Heartbeat, they are able to identify the gaps and lapses that the agents make while making such calls as it directly affects the fulfillment as well as customer satisfaction while loan repayment.

Customer Challenges

Any wrong information captured in the KYC verification call may lead to wrong credit rating and loan denial, this has direct impact on customer acquisition and company’s business. In addition, it also had the challenge of scaling & aggressively signing-up new clients due to such failures done by agents. Post the loan disbursal, the company makes calls for timely EMI repayments, the challenge here was to monitor the agents very closely so that both agents & customers emotions, sentiments and analytics can be monitored to analyze the prospects of recovery.

Hence to meet the challenge the company wanted a technology enabled platform using which the client can monitor calls for areas of Content, Communication for easy daily Workflows & conduct their business digitally without the need of scaling its own team of manual call auditors and trainers.

Partner

Solution

Heartbeat was a perfect fit with a customized feature to check CRM entries of agents. An additional feature mitigates day-to-day workflow enabled challenges through Heartbeat. It empowered the auditors & trainers to monitor calls and make the entire process accurate, fast & effective for all stakeholders.

The Heartbeat is a collaborative platform providing digital dexterity, deployed over AWS Serverless architecture so that it can handle scalability and robustness automatically. AWS hosting also makes Heartbeat cost effective solution because it works on Pay-per-use model and customer are getting benefits of world class hosted solution at lesser cost.

Major AWS services used in Heartbeat are –

- AI Models has been trained and deployed using AWS Batch and GPU EC2 Instances

- AWS Serverless architecture and pay-as-you-go model to manage the unpredictable load seamlessly in cost effective way

- Solution has been built using AWS managed services i.e. Aurora, S3, CloudFront, Lambda, API gateway, DynamoDB and Athena

Result & Benefits

- KYC information correctness improved by 70%

- Clients grew by 25% in 4 months

- Customer satisfaction improved by 63%

- Faster adoption

- Improved Revenue & Recoveries